The Build to Rent Equation

Build to Rent (BTR) is a major evolution in the way housing is owned and delivered in the Australian landscape.

Build to Rent Australia involves the institutional ownership of residential real estate at scale. These buildings are professionally managed to deliver an improved housing experience for residents across all locations, price points and income levels. BTR provides a faster journey from concept through to completion. This will be critical in supporting Australia’s current housing shortage.

BTR is relatively new to the Australian market, although it is not a new concept. In fact, this approach to housing is prevalent globally. Taking off in the US, throughout Europe and Asia and has recently taken root in the UK.

This paper highlights how BTR as an asset class is structured. Importantly, focussing on how it will reshape the Australian housing landscape. It will also present an outline of the opportunities for developers and investors to capitalise on the growth of BTR in Australia. The local market has a long way to catch up to its global peers as a percentage of the housing supply.

What is Build to Rent?

Build to Rent is the institutional ownership and operation of residential rental housing. To-date in Australia this has taken the form of apartment projects, typically over 150 units in size. This is rapidly evolving to include apartment and housing projects of varying size and location. BTR will provide housing across the full spectrum of income profiles.

The largest difference with how housing, specifically apartments, has been delivered and owned in Australia to date is in who the owner is. How and why do investors own rental properties. The implications that flow from these stark differences will be pivotal in years to come.

Traditional Build to Sell projects are targeted at a combination of owner-occupiers and investors. BTR projects are 100% owned through a single investor context. A BTS project might be partially pre-sold off the plan, with a hurdle typically required to be overcome before construction can commence. Conversely, a BTR project will have no pre-sales. These projects are typically funded with a combination of debt and equity, with a view to create an asset that can be rented out and operated for its income stream. Importantly protecting the buildings brand and reputation. The point in the delivery timeline at which the long-term investor deploys capital defines how the delivery is funded and the risks are apportioned.

Global Comparisons

Australia’s BTR market is in its infancy. Less than 10 purpose designed assets are operating as of October 2023. Comparatively, the BTR asset class is incredibly prevalent in markets globally.

Further below, the “US National Multifamily & Apartment Completions & Pipeline” chart highlights the relative new supply of BTS and BTR apartments in the US.

As can be seen, BTR/Multifamily makes up more than the lion’s share of new apartment deliveries.

In the UK, the industry started to rapidly take shape just 8 years ago. Now there are over 83,000 units completed and operational (Knight Frank Research; September 2023).

BTR is prevalent in other major economies and has rapidly emerged in the UK. The Australian market is about to experience a paradigm shift in how housing and apartments are developed, designed, operated and owned.

This shift will have as large an impact on how Australians live as did the urbanisation of our cities did. The major shift towards apartment living that has played out over the last 25 years.

How do BTR projects differ from BTS?

The motives, objectives and influence of ownership changes dramatically when rental housing is owned in one line.

Institutional ownership introduces new objectives and provides the operators with the decision making power to pursue these.

These motives and objectives vary significantly from project to project, asset to asset and include the following:

– Providing housing for lower-income or key-worker households.

– Defensive investment.

– Portfolio diversification.

– Secure, inflation protected cash flows.

– Profit maximisations.

The objectives vary, however the typical differences hold true across the sector and are outlined at the end of this paper.

How are Build to Rent assets funded and delivered?

There are many ways in which BTR projects are funded through a wide spectrum of capital investors with different risk and return objectives.

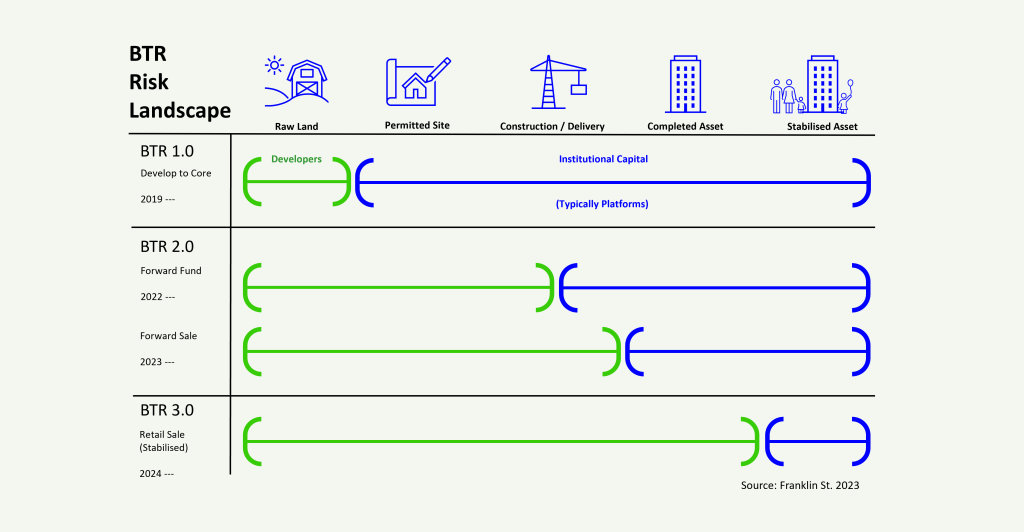

In a mature market there are typically four main approaches in how development is structured:

– Platform Model.

– Forward Fund.

– Forward Sale.

– Retail Sale.

The main difference across this spectrum is in defining who is responsible for the various risks associated with ownership and development.

Under the the vertically integrated platform model, capital is typically exposed to delivery risk (including managing the builder). This is a step further than passive funds and takes the risk exposure all the way through to to operations that comes from owning the completed asset. This approach introduces planning risk in certain instances as well as return hurdles to match.

With a Forward Fund, passive capital is looking to offload the planning and delivery risk to a capable developer who is an expert in this process. The investor funds the cost of delivery and acquires the land prior to construction. Further, this minimises its delivery risk but offers an opportunity to own the asset closer to its raw cost.

A Forward Sale involves an investor committing to purchase the asset upon successful completion. This further reduces the delivery risk to the investor, but likely increases the cost to acquire the asset accordingly.

Finally, investors can purchase stabilised and operating assets at a full retail value, similar to acquiring an operational retail or office asset. This approach entails the least risk but is typically the highest price compared to other structures.

Build to Rent Misconceptions

Outlined below are some common misconceptions about the BTR asset class.

A) BTR is just high-end, unaffordable rental units.

Early projects to get off the ground in Australia were pitched at the higher income brackets, however the market has evolved significantly since then. Looking to the US market, multifamily (BTR) provides housing at all levels of the location, scale and price spectrum. Affordable through to Premium.

The Australian market has already seen the evolution of offerings. New emerging capital and operators are focused on key worker housing or high ESG aspirations. We have witnessed product at both ends of the spectrum. This is due to a requirement for revenue, or associated tax savings in affordable product. We believe the middle will fill out from here.

B) BTR will singlehandedly solve Australia’s housing crisis.

Australia is heading headfirst into a worsening housing crisis. New supply is at historical lows. Rental growth is out pacing wages and net overseas migration is at record highs as a proportion of the total population. Australia needs more supply and fast.

BTR is only one solution on the table to address this undersupply. BTR projects can get to market faster than BTS with no need for pre-sales, however these projects need to be financially viable. Developers are currently having to work within a high-cost inflationary construction environment.

To solve a housing crisis of the scale Australia is experiencing, solutions need to come from all corners of the market.

Summary

The BTR Equation has many inputs and can produce very different outputs. From affordable to market rate and inner-city high rise to outer-ring campus-style projects, Build to Rent Australia can take many forms.

Understanding the inputs to balance the equation is critical.

Franklin St. is at the cutting edge of the BTR Australia market. Utilising our tangible global experience in this sector, we are here to bring more projects to life, helping to balance the supply / demand for housing in Australia for the current and next generations.

To learn how ESG & ESD can affect your Build to Rent project we have further readings on our News page.

Sources: Dodge Data & Analytics